Pagos fáciles

Seleccione el destinatario y envíe una transferencia de dinero, o una transferencia interna instantánea.

Seguridad de grado bancario

Todos los datos están cifrados SHA-512 en reposo y en tránsito; 100% alojados detrás de los cortafuegos de AWS.

Permisos de usuario

Gestione el acceso, los derechos de aprobación y los límites de transferencia a nivel de usuario y de cuenta.

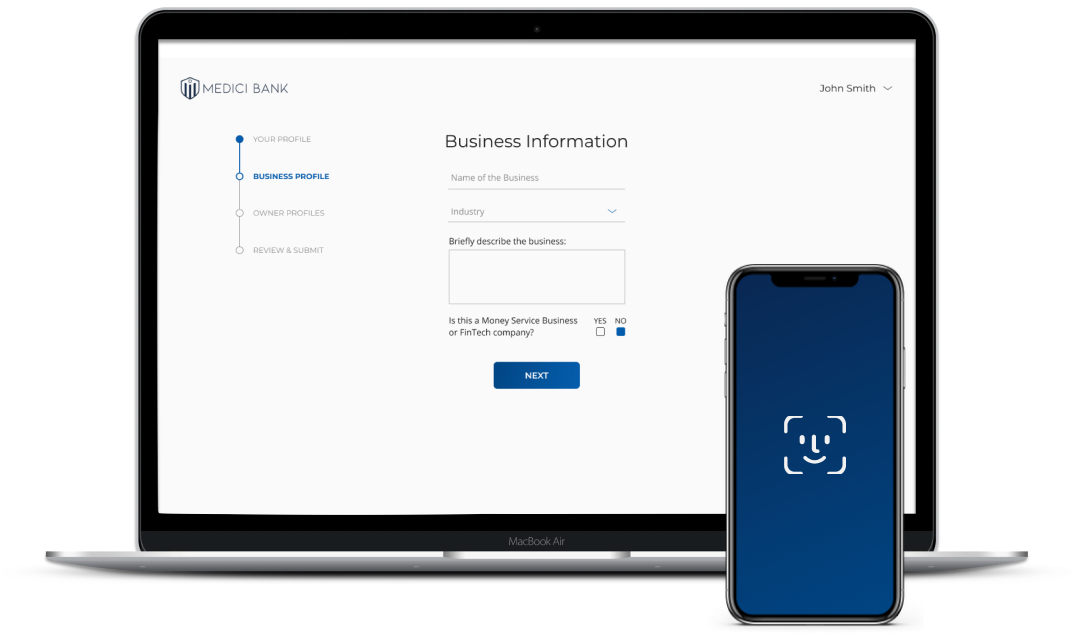

Autentificación multifactorial

Autentificación multifactorial basada en la aplicación del teléfono inteligente para iniciar sesión y transferir.

Homologaciones de varios niveles

Disponga de hasta 4 niveles de aprobación basados en los importes de las transferencias personalizadas.

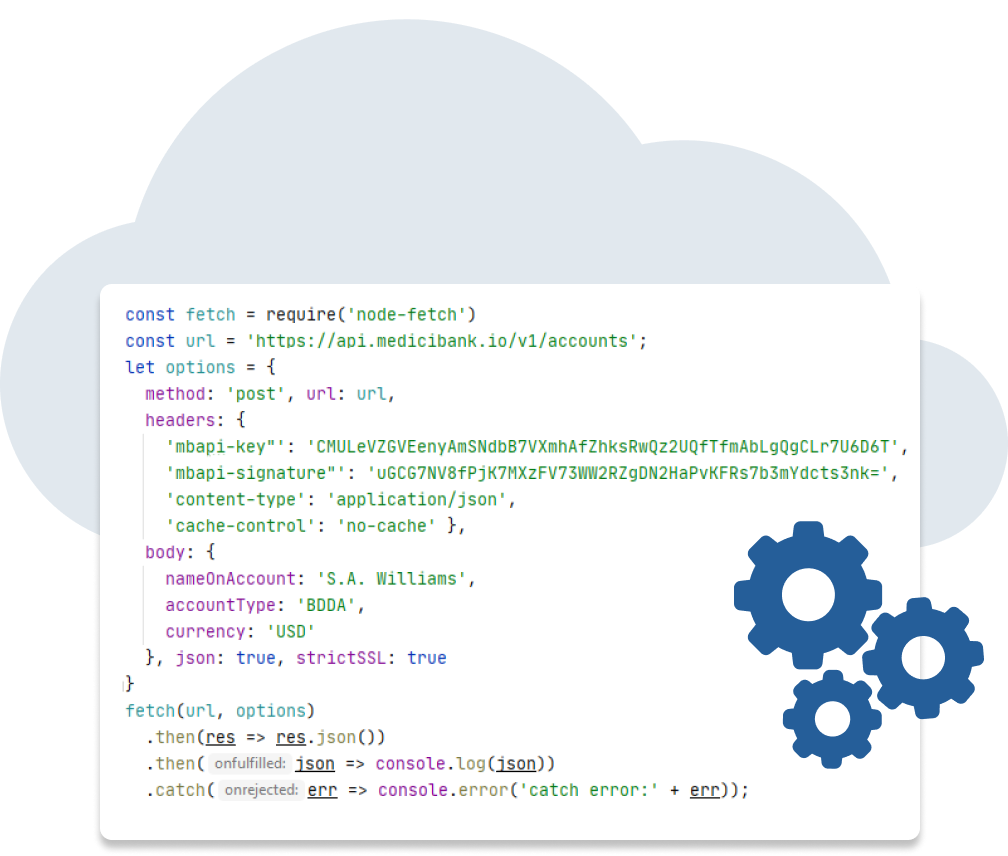

Banca incorporada

Moderna API de microservicios REST/JSON para conectar el banco directamente a sus sistemas.